Life Insurance Made Easy: Simplifying the Decision-Making Process introduction:Life insurance is one of the most critical financial tools for ensuring the security and well-being of your loved ones. However, navigating through the plethora of options and understanding the complex jargon can be daunting. In this article, we aim to demystify the process of choosing life insurance by breaking down the key components and providing practical insights to empower you in making informed decisions.

Understanding the Basics: Before delving into the specifics, let’s establish a foundational understanding of life insurance. At its core, life insurance is a contract between an individual and an insurance company, where the insurer promises to provide a sum of money to designated beneficiaries upon the insured’s death. This payout, known as the death benefit, serves as a financial safety net to cover various expenses and replace lost income.

Types of Life Insurance: Life insurance policies come in various forms, each catering to different needs and preferences. The two primary categories are term life insurance and permanent life insurance. Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years, and pays out the death benefit if the insured passes away during the term. On the other hand, permanent life insurance, which includes whole life and universal life policies, provides coverage for the insured’s entire life and often includes a cash value component that accumulates over time.

Determining Coverage Needs: One of the fundamental questions when purchasing life insurance is determining how much coverage is sufficient. Several factors influence this decision, including:

- Income Replacement: Consider the amount needed to replace your income and maintain your family’s standard of living in your absence.

- Debt and Expenses: Factor in outstanding debts, such as mortgages, loans, and educational expenses, as well as ongoing living expenses.

- Future Needs: Anticipate future financial obligations, such as college tuition for children or retirement savings for a spouse.

- Existing Resources: Take into account existing savings, investments, and other sources of financial support that can supplement the life insurance payout.

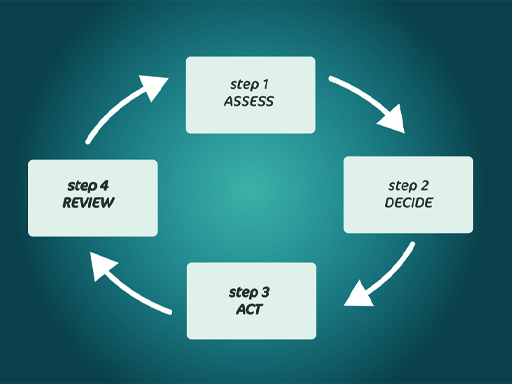

Assessing Your Options: Once you’ve assessed your coverage needs, it’s time to explore your options and select a policy that aligns with your goals and budget. Here are some key considerations:

- Premiums: Evaluate the cost of premiums for different policies and choose one that fits within your budget while providing adequate coverage.

- Policy Features: Compare the features and benefits of various policies, such as flexibility in premiums and the ability to adjust coverage over time.

- Insurer Reputation: Research the financial stability and reputation of insurance companies to ensure they can fulfill their obligations in the future.

- Riders and Add-Ons: Explore optional riders and add-ons that can enhance your policy’s coverage, such as accelerated death benefits or waiver of premium riders.

Seeking Professional Guidance: Navigating the intricacies of life insurance can be overwhelming, especially for those unfamiliar with financial terminology and concepts. Consider seeking guidance from a licensed insurance agent or financial advisor who can provide personalized recommendations based on your unique circumstances and objectives. An experienced professional can help you navigate the decision-making process, clarify any uncertainties, and ensure that you make choices aligned with your financial goals.

Conclusion: Life insurance is a crucial component of financial planning, providing peace of mind and financial security to your loved ones in the event of your passing. By understanding the basics, assessing your coverage needs, exploring your options, and seeking professional guidance when needed, you can simplify the decision-making process and make informed choices that protect your family’s future.