Decoding Life Insurance: Finding Your Perfect Fit Introduction:

Life insurance is more than just a safety net; it’s a crucial financial tool that provides peace of mind and security for you and your loved ones. However, navigating the multitude of options available in the market can be daunting. From term life to whole life, variable to universal, each policy comes with its own set of features, benefits, and costs. In this comprehensive guide, we’ll delve into the intricacies of life insurance, helping you decipher the jargon and choose the policy that best suits your needs.

Understanding Your Needs:

Before diving into the specifics of life insurance policies, it’s essential to assess your financial situation and future goals. Are you the sole breadwinner in your family? Do you have dependents who rely on your income? Are there outstanding debts or mortgage payments that need to be covered in the event of your passing? By answering these questions, you can determine the amount of coverage you require and the type of policy that aligns with your objectives.

Types of Life Insurance Policies:

1. Term Life Insurance:

– Ideal for individuals seeking affordable coverage for a specific period, typically ranging from 10 to 30 years.

– Offers a death benefit to beneficiaries if the policyholder passes away during the term.

– Premiums remain level throughout the term, making budgeting easier.

2. Whole Life Insurance:

– Provides lifelong coverage with a guaranteed death benefit.

– Accumulates cash value over time, which can be accessed through withdrawals or loans.

– Premiums are typically higher than term life insurance but remain constant throughout the policyholder’s life.

3. Universal Life Insurance:

– Offers flexibility in premium payments and death benefits.

– Accumulates cash value at a variable interest rate.

– Allows policyholders to adjust coverage and premiums based on changing financial circumstances.

4. Variable Life Insurance:

– Combines life insurance coverage with investment opportunities.

– Policyholders can allocate premiums to various investment options, such as stocks, bonds, or mutual funds.

– Cash value and death benefits are subject to market performance, offering potential for growth but also risk.

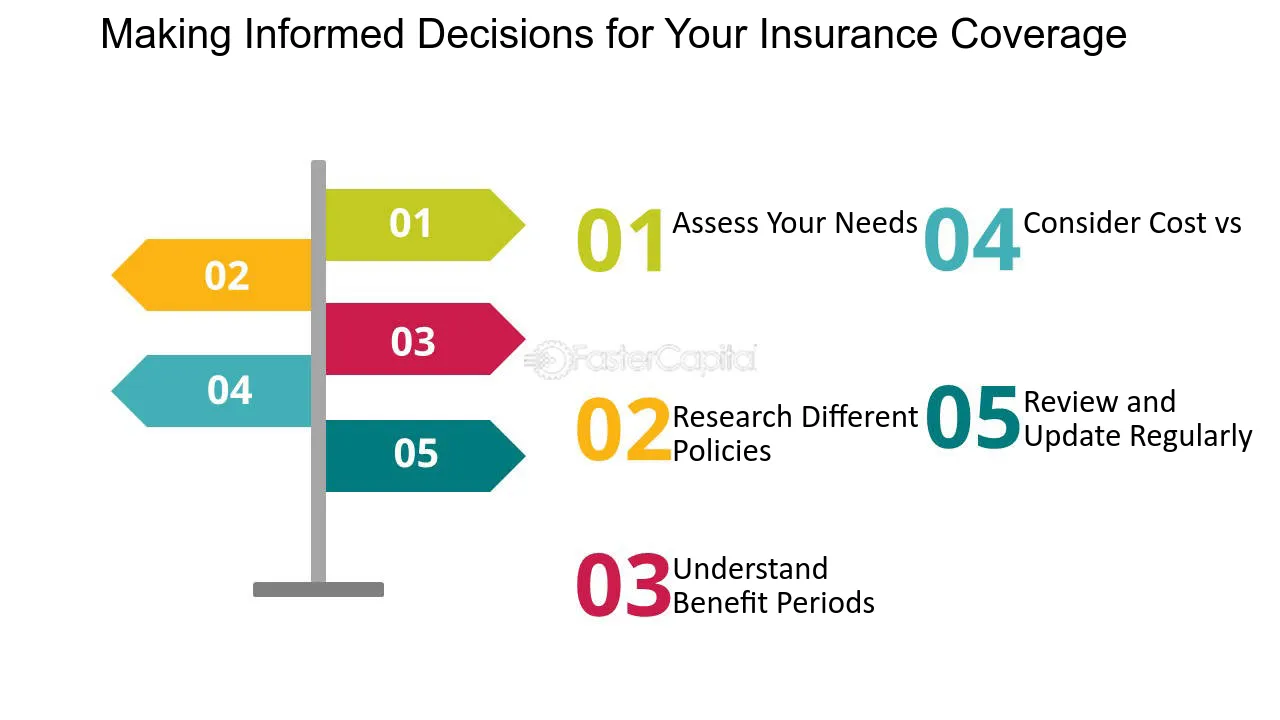

Choosing the Right Policy:

When selecting a life insurance policy, it’s essential to consider factors such as affordability, coverage duration, and investment objectives. Here are some tips to help you make an informed decision:

– Evaluate your current financial situation and future needs.

– Compare quotes from multiple insurance providers to find the best rates.

– Consider the reputation and financial stability of the insurance company.

– Review the policy’s terms and conditions, including any exclusions or limitations.

– Consult with a financial advisor or insurance agent to ensure you understand all aspects of the policy.

Conclusion:

Finding the right life insurance policy requires careful consideration of your individual circumstances and financial goals. Whether you opt for term life, whole life, universal, or variable insurance, the key is to choose a policy that provides adequate coverage at an affordable price. By understanding the different types of policies available and seeking guidance from financial professionals, you can secure your family’s financial future and gain peace of mind knowing they’ll be protected no matter what life may bring.