The Essential Checklist for Purchasing Life Insurance: Your Comprehensive Guide Introduction: Understanding the importance of life insurance and how it fits into your financial planning is crucial. This comprehensive checklist will walk you through the essential factors to consider before purchasing life insurance.

1. Assess Your Needs:

Before diving into the intricacies of life insurance policies, evaluate your financial situation, liabilities, and dependents. Use tools like income replacement calculators to determine the coverage amount needed.

2. Understand Different Types of Life Insurance:

Explore the nuances between term life, whole life, universal life, and other types of insurance. Each has its benefits and drawbacks, catering to diverse financial goals and needs.

3. Evaluate Your Budget:

Life insurance premiums vary based on coverage amount, policy type, age, and health. Analyze your budget to ensure the premiums are sustainable in the long term. Consider options like term life for more affordable coverage.

4. Research Insurance Providers:

Look beyond premiums and delve into the reputation, financial stability, and customer service of insurance companies. Check ratings from agencies like A.M. Best and customer reviews for insights.

5. Assess Additional Riders:

Riders offer additional benefits to your life insurance policy but come at an extra cost. Evaluate riders like accidental death benefit, waiver of premium, or critical illness coverage based on your needs.

6. Understand Underwriting Process:

Learn about the underwriting process, which determines your eligibility and premium rates based on factors like age, health, and lifestyle choices. Be transparent during the application process to avoid complications later.

7. Review Policy Flexibility:

Flexibility is key in adapting your policy to life changes. Review options for converting term policies to permanent or adjusting coverage amounts as your financial situation evolves.

8. Compare Quotes:

Request quotes from multiple insurance providers to compare premiums, coverage, and benefits. Online comparison tools can streamline this process and help you make an informed decision.

9. Seek Professional Advice:

Consult with a licensed insurance agent or financial advisor to navigate the complexities of life insurance. They can provide personalized recommendations based on your financial goals and risk tolerance.

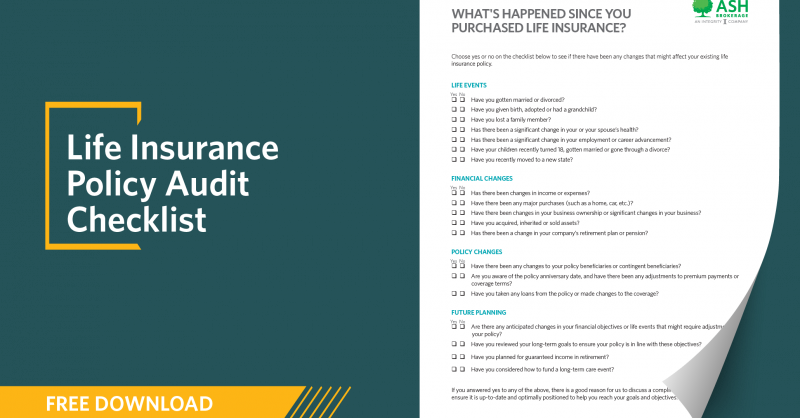

10. Revisit and Update Regularly:

Life insurance needs evolve over time with changes in income, family dynamics, and financial goals. Regularly revisit your policy to ensure it aligns with your current circumstances and make updates as needed.

Conclusion: Purchasing life insurance is a significant decision that requires careful consideration and planning. By following this essential checklist, you can navigate the process with confidence, securing financial protection for yourself and your loved ones.